CapitaLand Group (CapitaLand) is one of Asia’s largest diversified real estate groups. Headquartered in Singapore, CapitaLand’s portfolio focuses on real asset management and real estate development, spanning across 270 cities in 45 countries.

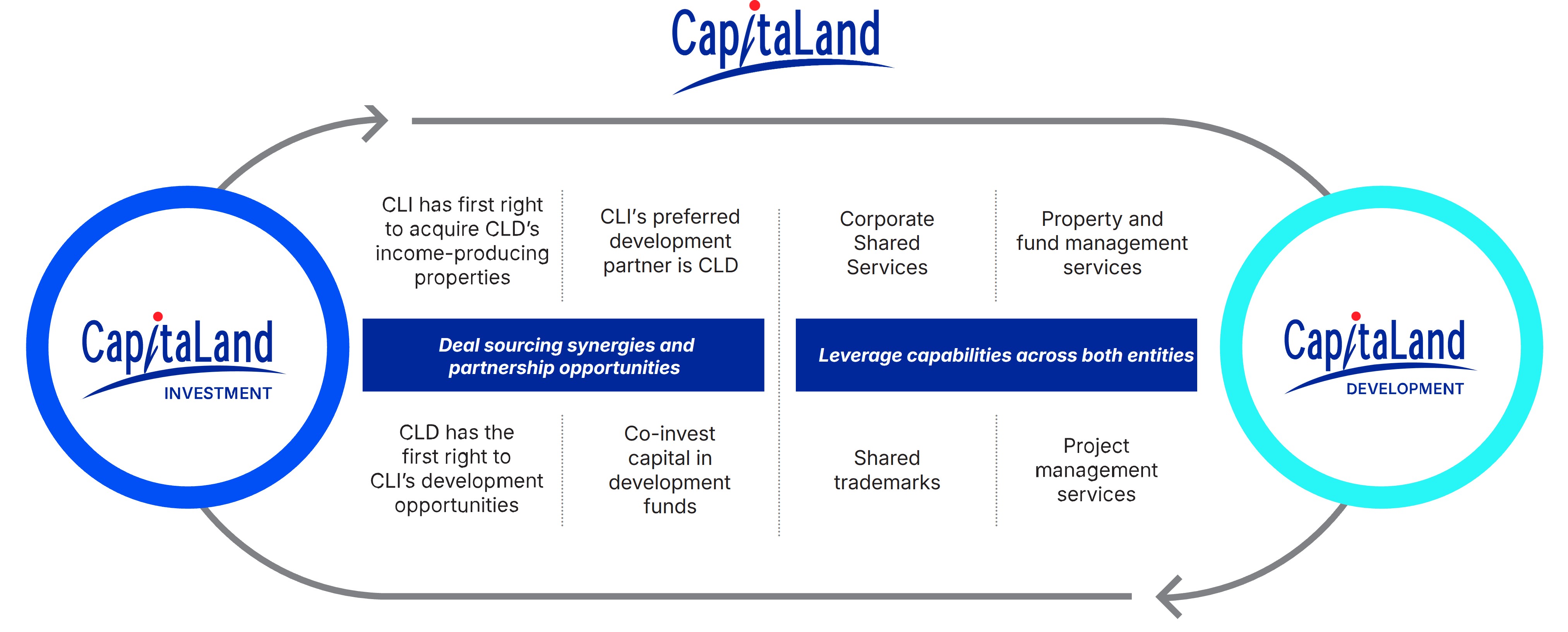

In 2025, CapitaLand celebrates 25 years of excellence in real estate and continues to innovate and shape the industry. Within its ecosystem, CapitaLand has developed an integrated suite of real asset management, real estate development, and operating capabilities that support its businesses in building core competencies across the value chain. With this full range of capabilities, CapitaLand can optimise the strategies of its listed real estate investment management business, CapitaLand Investment, and its privately held property development arm, CapitaLand Development, to drive competitive advantage for its businesses.

CapitaLand places sustainability at the core of what it does. As a responsible real estate company, CapitaLand contributes to the environmental and social well-being of the communities where it operates, as it delivers long-term economic value to its stakeholders.

CapitaLand Investment India

CapitaLand Investment India has deep expertise in India across the full real estate value chain - from owning, developing and managing properties to fund management through CapitaLand India Trust and private funds.

CapitaLand Development India

CapitaLand Development, the development arm of CapitaLand Group, has a sole asset in India, OneHub Chennai (OHC). OHC is a next generation Industrial Township spanning 1,250 acres (506 Ha). Located 50 km south of Chennai city, OHC offers multi-modal logistics connectivity, plug and play infrastructure, clear land title, facilitation support for all statutory clearances and well-planned social infrastructure for hassle-free business operations.

Our Ecosystem

Notes:

1The ROFR gives CLI a right of first refusal under certain terms and conditions to acquire Relevant Assets that CapitaLand or any of its subsidiaries wishes to dispose of. CLI may exercise the right to acquire the Relevant Assets (or, as the case may be, the interests in the Relevant Assets) for its own portfolio of pipeline assets, or CLI may exercise it in favour of any Relevant CLI Entity. “Relevant Assets” refers to any operational, income-producing properties for the following non-exhaustive uses: residential, retail, office, business park, industrial, logistics, data centre and mixed use properties, and lodging related (including multifamily, student accommodation, hotels and serviced apartments, amongst others) located anywhere in the world, and where the context so admits, shall include the shares and equity interests of any single purpose company or entity established to hold the Relevant Asset.